kern county property tax assessor

Use our online tool to check for foreclosure notices and tax liens on a property. This amount will be payable to the Kern County Treasurer-Tax Collector in the amount of the transaction and be deemed as a payment to the Kern County Treasurer-Tax Collector.

Pin By James Kern On Favorite Places Spaces South Florida Fun Florida Vacation Florida Travel

The assessors parcel maps are located on the Assessors Office web page.

. Assessment Information for Tax Year. Purchase a Birth Death or Marriage Certificate. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Application for Tax Relief for Military Personnel. Search for Recorded Documents or Maps. Request a Value Review.

Request For Escape Assessment Installment Plan. SEE Detailed property tax report for 10804 Thunder Falls Ave Kern County CA. Ad 1Search Any Address 2Find Property Records Deeds Mortgage Much More.

File an Exemption or Exclusion. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. Handled by the Assessors Office Application to Reapply Erroneous Tax Payment.

Get Information on Supplemental Assessments. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays. Change a Mailing Address.

Ad Find Out the Market Value of Any Property and Past Sale Prices. They are maintained by various government offices in Kern County California State and at the Federal level. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments.

No CDs to load no concerns about dated information. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. Exclusions Exemptions Property Tax Relief.

File an Exemption or Exclusion. Request a Value Review. Kern County collects on average 08 of a propertys assessed fair market value as property tax.

The County of Kern assumes no responsibility arising from the use of this information. Business. Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. If you inadvertently authorize duplicate transactions for any. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45000 or less among other requirements.

Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. Access vital information from any internet. The majority of Assessor forms are developed and provided by the California State Board of Equalization.

Get In-Depth Property Reports Info You May Not Find On Other Sites. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. Kern County Assessor GIS.

Please select your browser below to view instructions. Establecer un Plan de Pagos. Decline-in-Value Review Proposition 8 Assessment Appeals.

Change a Mailing Address. Cookies need to be enabled to alert you of status changes on this website. Moreover what is Kern County property tax.

2021 Lien Date Bill. Get driving directions to this office. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property.

Welcome to the Kern County online tax sale auction website. Search for Recorded Documents or Maps. Property Tax Important Dates.

Assessors Parcel Map Search. Please enable cookies for this site. They are a valuable tool for the real estate industry offering both.

661 868 3485 Phone The Kern County Tax Assessors Office is located in Bakersfield California. Get Information on Supplemental Assessments. File an Assessment Appeal.

Search Valuable Data On A Property. Pressing a button loads those features in the assessor book at the center of the screen. Find Property Assessment Data Maps.

Supplemental Assessments. DeedAuction is part of our offices. 011-018 1 Year General Amt Special Amt Special Asmnts General Rate.

Start Your Homeowner Search Today. Ad Get In-Depth Property Tax Data In Minutes. Purchase a Birth Death or Marriage Certificate.

Full cash value may be interpreted as market value. A Notice of Supplemental Assessment relates to a new assessment resulting from a change in ownership or new construction. Find Property Assessment Data Maps.

You may move and load multiple times for more features. Questions regarding tax bills should be directed to the Tax Collector at 661 868-3490. Connect from the office home road or around the world.

File an Assessment Appeal. How to Use the Assessors Parcel Map Search Maps are in the TIFF image format. 119-004 SO KERN CO UNIFIED.

Application for Tax Penalty Relief. If you are having trouble viewingcompleting the forms you will need to download. The Assessor-Recorder establishes the valuations.

If you have questions regarding your propertys value the Assessor-Recorder can be. Land Clear APN label Use CD label Neighborhoods Clear Mineral Clear Kern Zoning Clear BFL Zoning Clear Crops Clear Flood Zones Clear Oil Wells Clear AIN Oil Wells Clear. In addition to the forms listed below more forms related to Changes in Ownership Exemptions Exclusions Business Personal Property and Tax Savings Programs are made available through a partnership with the California Assessors Association at Cal.

Tax description Assessed value Tax rate. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Bakersfield California 93301.

Such As Deeds Liens Property Tax More. Net Billed Value Tax Rate Area Proration Period. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays.

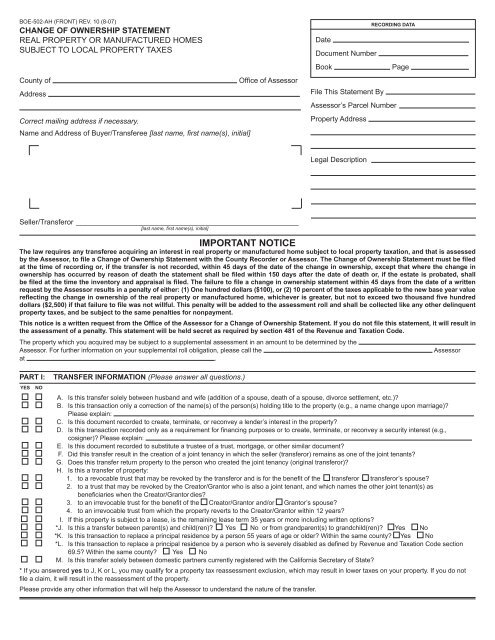

Important Notice Kern County Assessor Recorder

Land For Sale In California Land For Sale Mohave County Rural Land

Places To Visit In L A Malibu Hindu Temple In Calab Hindu Temple Calabasas Homes Property Design

California Public Records Public Records California Public

![]()

Pennsylvania Conventional Well Map Update Fractracker Alliance

Lapd Metro Detention Center Jail Lapd Los Angeles Police Department

10412 10642 Lower Azusa Road El Monte Ca 91731 Azusa Lower Road

Line 851 Serves Glendora And Covina Popular Destinations Include South Hills High School Royal Oak Intermediate Covina Washington Elementary School Glendora

Important Notice Kern County Assessor Recorder

Melbourne Fl Big Orange Roadside Attractions Visit Florida Road Trip Usa

Important Notice Kern County Assessor Recorder

Important Notice Kern County Assessor Recorder

Frank Sinatra S Song The New Yorker

Important Notice Kern County Assessor Recorder

Important Notice Kern County Assessor Recorder

Well Water Metering Not On My Land Say California Landowners